This AM, I listened to the Diane Rehm Show on NPR. Her guest was Peter Peterson—founder of the Concord Coalition with Warren Rudman and Paul Tsongas—the Secretary of Commerce in the Trickster's administration. Peterson makes sense. He is not an expert in male bovine excrement. He gives the back of his hand to both Democrats and Republicans. He is dispassionate and rational. I learned more from him in one hour than I have in a lifetime. If this is (fair & balanced) common sense, so be it.

[x Centrists.Org - The Policy Think Tank for Centrists]

Book Summary: Running on Empty

A new book by Pete Peterson, former secretary of commerce and founding president of the Concord Coalition, warns that Democrats' fealty to entitlements and Republicans' devotion to tax cuts threaten to bankrupt the nation. Here is a chapter-by-chapter summary.

Running on Empty – How the Democratic and Republican Parties are Bankrupting Our Future and What Americans Can Do About It

Preface: “Why This Book Now” Peterson believes the nation faces imminent financial meltdown generated by:

- The failure of government to respond to domestic and international challenges from a rapidly aging population;

- Excessive expansion of government spending programs, particularly entitlement programs that mandate future payments regardless of individual income or need; and

- Reductions of long term revenue from poorly designed tax reform initiatives.

His stated goal, according to the preface, is to alert the American people to this threat to their long term prosperity, describe how the crisis developed and proposes public policies to forestall, or at least alleviate, the coming “Grey Dawn”.

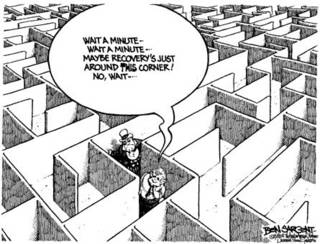

Chapter 1: “Bankrupt Parties, Bankrupt Nations” Peterson maintains both major political parties have been “captured” by their own respective extremists. Republicans have embraced a strong anti-tax agenda predicated on reducing government revenues as a percentage of GDP while using expanded government spending to pursue a neo-imperial foreign policy and a compassionate conservative domestic agenda. Democrats have “turned the federal government into a massive entitlements vending machine which operates by dispensing new benefits in return for organized political support and by deferring costs as far as possible into the future.” The common denominator between the two parties is their mutual willingness to embrace expanded current consumption, albeit for divergent goals, while deferring the costs as far into the future as possible.

Chapter 2: “Why Deficits Matter To You And Your Future” This chapter describes the anticipated growth of federal deficits and their potential impact on the economy. It also reviews potential methods of financing future expenditures, particularly foreign borrowing. Finally, Peterson discusses the decisions to raise taxes or to cut benefits; the hard choices that may face the next generation if foreign investors become unwilling to lend the money necessary to finance U.S. government expenditures.

Chapter 3: “The Challenge At Home – The Aging of America” This chapter is largely derived form Peterson’s earlier book “Grey Dawn”. He describes the prolonged aging of the baby boom generation facilitated by advances in medical science and the baby bust phenomenon caused by low fertility rates, particularly among affluent families. The net result is that as older Americans become eligible for age related government benefits, there are progressively fewer working age individuals available to generate the revenues necessary to pay those benefits. Peterson maintains it is unreasonable to expect economic growth to compensate for the mismatch between workers and retirees because growth in GDP is closely liked to increased population. He also believes society will be unable to generate enough savings from eliminating waste to balance revenues and obligations.

Chapter 4: “The Challenge Abroad – A Dangerous World” This chapter discusses the international implications of the “Grey Dawn” theme. Peterson maintains the demands of the global war on terrorism and homeland security will require increased federal expenditures far into the future. Unfortunately, the United States will probably need to finance most of this conflict with little if any monetary assistance from other nations. Almost all developed or “first world” nations have aging populations similar to our own. In some countries the phenomenon is even more advanced. Consequently, they are facing severe funding problems of their own and have little ability to fund more than their own internal security efforts. Additionally, many foreign investors, particularly central banks that have parked their funds in the U.S. may pull them out in the near future. Foreign governments may want to retrieve their money to fund their own domestic programs and foreign private sector investors may seek higher and/or safer rates of return than available in the United States. Finally, Peterson warns that if the U.S. attempts to become a “shoestring superpower” (by allocating insufficient money, time and effort to be effective), we may actually make the global situation worse instead of better.

Chapter 5: “How The Democrats Got Us Into This Mess (With Republican Help)” This chapter describes the creation and expansion of major entitlement programs. Peterson maintains Democrat policy makers, including Franklin Roosevelt knew their programs were based on faulty economic assumptions and moved ahead anyway. Some of these programs were developed in response to genuine needs. Others were simply designed to buy political support from targeted special interest groups. All were deliberately designed to be larger than necessary in order to gain support from more affluent voters who might otherwise have objected to expenditures more tightly targeted to low income families. Once these programs were established, their funding became almost automatic. In the case of individual entitlements, the funding became mandatory and the government could be sued if it failed to provide the promised benefits. Although Democrats started this process, Republicans have also used expanded entitlement spending to curry favor with special interest groups. Peterson points out that according to a 2002 government survey, only about 4.2 percent of all senior citizens had a major problem affording prescription drugs. Nevertheless, Republicans pushed through the largest expansion of entitlement spending in 30 years in order to placate AARP and other senior citizen lobbies. Meanwhile Democrats attacked the new $400 billion program for not being generous enough.

Chapter 6: “How The Republicans Got Us Much Deeper (With Democratic Help)” This chapter examines tax reform efforts, starting with President Reagan’s “Emergency Recovery Tax Act”. Peterson acknowledges the need for substantial tax reform in 1980 but maintains the Republican tax strategy went too far resulting in an annual revenue loss of $660 billion more than had been anticipated. He also points out that President Reagan had campaigned for office on a pledge to cut spending as well as taxes. When Congress refused to reduce spending, the result was spiraling deficits, quickly followed by tax increases in 1982, 1983, 1984, 1986 and 1990. Peterson believes this series of rapid tax increases motivated “tax cut diehards” to become more organized, motivated and proactive in establishing opposition to tax increases as a litmus test for Republican Party loyalty. Over the course of the 1990s, these activists became more effective and more influential. When President Bush (41) raised taxes in 1990, anti-tax Republicans abandoned him, leading to the election of President Clinton in 1992. In 1993 these activists were able to boast that not a single Republican in Congress voted for any form of President Clinton’s tax increases. Finally, they were a key component in helping to elect the current President Bush who has successfully advocated major tax cuts in every year of his administration. Peterson asserts this series of tax cuts has actually limited the ability to reduce spending. “ ‘Republicans chop checks to widows so CEOs can get tax-free golden parachutes’ is a claim that if the Democrats could ever make it stick, would be a free ticket to electoral victory.” Furthermore, Republicans appear to have embraced big government and expanded spending.

Chapter 7: “Ten Partisan Myths” According to Peterson “The high art of governing is all about strong principles, practical wisdom, and making tough choices. The low art of getting elected is all about spinning, denial, pandering, playacting, deal-making and creative accommodation – when it’s not about outright deception and fraud” This has led to five popular Democrat talking points in favor of increased entitlement spending and five common Republican arguments in favor of tax cuts. (Peterson response in italics)

- Because federal benefits go to the poor, reform will amount to a shredding of our social safety net. Only about twelve cents of every dollar goes to low income families.

- Even if they don’t go mostly to the poor, federal benefits foster equality by going mostly to lower-income households.The vast majority of federal benefits are redistributed among middle class and affluent families.

- Federal benefits go mostly to the elderly, whom everyone knows are much less well-off than younger Americans. As a group, the elderly are actually more well off than the rest of the population.

- Social Security and Medicare are earned rights, as in a contract; beneficiaries are only getting back what they paid in. Peterson believes Social security is more of a Ponzi scheme than a contract.

- The future growth in the cost of senior benefits, whatever that may be, can easily be borne by younger generations. The actuarial reports indicate these costs will exceed future generations’ income.

- Because the American people are overtaxed, they want and deserve our tax cuts. Unless you cut spending, you cannot cut taxes but only shift them to the future.

- Our tax cuts are still a sensible near-term means of stimulating a weak economy. The 2001, 2002, & 2003 tax cuts delivered little short term stimulus.

- Our tax cuts make the tax code more efficient. Yes, but the cost is excessive and reduces revenues more than we can afford.

- Our tax cuts are really about improving “supply side” incentives. This was true of the Reagan tax cut that reduced marginal rates from 70 to 50 percent but not of current tax cuts that only reduce rates from 39 to 35 percent.

- In the long run our tax cuts will force Congress to cut spending. This tactic is unfair, cynical and hypocritical. Also, it will not work. Democrats will simply allow the deficit to expand and maintain or increase spending.

Chapter 8: “Why America Is Choosing The Wrong Future” Peterson maintains our nations current political climate and fiscal policies are leading toward future disaster. Some people believe we will avoid long term meltdown because we are a divinely chosen nation protected by god from the natural consequences of our own poor choices. Others believe in a natural cycle of national growth, prosperity, decline and ruin that cannot be altered. Peterson believes we have the ability to determine our own destiny but only if we take action now. Leaders must be educated about the looming crises and the policies necessary to avert disaster. The public must be educated to select and support leaders willing to make tough policy decisions.

Chapter 9: “How We Can Rebuild Our Future – And Our Politics” Peterson proposes extensive reforms for Social Security, Medicare, the Congressional Budget Process and electoral politics.

Social Security

- Index new benefits to prices instead of wages

- Mandate savings in personal retirement accounts that are invested in a mix of global equity and fixed income index funds

- Fortify Social Security’s safety net for the poor

Medicare

- Curb waste and fraud by moving toward managed competition

- Keep costs down by promoting cost sharing and gate-keeping

- Establish an independent entity to study best medical practices

- Reduce litigation costs by instituting medical malpractice reform

- Promote public health to combat obesity and unhealthy lifestyle choices

- Initiate a national reform agenda on global caps and hard choices

Congressional Budget Process

- Reinstate PayGo

- Issue a comprehensive long term (50 years) budget

- Develop accrual and generational accounting

Politics and Parties

- End the Gerrymandering of House Districts

- Neutralize the campaign funding problem (by requiring broadcasters to provide free air time)

- Educate young people about fiscal realities and about civic responsibilities

Chapter 10: “A Letter To The Rising Generation” Your parents’ generation did the best they could and if they made some mistakes, it was with the best of intentions. Do not judge them too harshly.

Peter G. Peterson is Chairman and Co-Founder of The Blackstone Group. He is Chairman of the Council on Foreign Relations, founding Chairman of the Institute for International Economics (Washington, D.C.) and founding President of The Concord Coalition. The Concord Coalition is a bi-partisan citizen’s group he organized in 1992 together with former Senators Warren Rudman and the late Paul Tsongas (who was succeeded by Senator Robert Kerrey). The Concord Coalition is dedicated to building a constituency of fiscal responsibility.

Mr. Peterson is the Co-Chair of The Conference Board Commission on Public Trust and Private Enterprises (Co-Chaired by John Snow, currently Secretary of the Treasury). He was also Chairman of the Federal Reserve Bank of New York from 2000 to 2004.

Prior to founding Blackstone, Mr. Peterson was Chairman and CEO of Lehman Brothers (1973–1977) and later Chairman and CEO of Lehman Brothers, Kuhn, Loeb Inc. (1977–1984). He was Chairman and CEO of Bell and Howell Corporation from 1963 to 1971.

In 1971, President Richard Nixon named Mr. Peterson Assistant to the President for International Economic Affairs. He was named Secretary of Commerce by President Nixon in 1972. At that time he also assumed the Chairmanship of President Nixon’s National Commission on Productivity and was appointed U.S. Chairman of the U.S.–Soviet Commercial Commission, which negotiated comprehensive trade, Ex-Im credit, arbitration, copyright and lend-lease agreements. In February of 1994, President Clinton named Mr. Peterson as a member of the Bi-Partisan Commission on Entitlement and Tax Reform co-chaired by Senators Kerrey and Danforth.

Mr. Peterson was formerly a Director of Sony Corporation, Minnesota Mining and Manufacturing Company, Federated Department Stores, Black & Decker Manufacturing Company, General Foods Corporation, RCA, The Continental Group, and Cities Service. Mr. Peterson is a Trustee of the Committee for Economic Development, the Japan Society and the Museum of Modern Art and a Director of the National Bureau of Economic Research, the Public Agenda Foundation and The Nixon Center.

In 1982, he was a founding member of the Bi-Partisan Budget Appeal, an organization of 500 heads of major organizations, accounting, law and banking firms, university and former public officials.

Mr. Peterson is the author of several books, including Running On Empty: How the Democratic and Republican Parties are Bankrupting Our Future and What Americans Can Do About It; Gray Dawn: How the Coming Age Wave Will Transform America – and the World; Will America Grow Up Before It Grows Old?; and Facing Up: How to Rescue the Economy from Crushing Debt and Restore the American Dream.

He has been awarded honorary PhD degrees by Colgate University, Georgetown University, George Washington University, Northwestern University, New School University, the University of Rochester, and Southampton College of Long Island University.

Centrists.Org is a non-partisan, non-profit, organization formed under section 501(c)(3) of the tax code, and dedicated to public education on vital public policy matters. Contributions to Centrists.Org are tax deductible.

Copyright © 2004 Centrists.Org